Inclusive Hiring: Empowering Disabled Workers

Explore how inclusive hiring, accessibility, and structured support empower workers with disabilities and create stronger, more innovative workplaces. ...more

Staffing

July 08, 2025•5 min read

How Staffing Trends Are Shaping 2025 Workplaces

Explore the staffing trends shaping workplaces in 2025, including flexible models, remote work, AI-driven recruitment, and Gen Z expectations. Stay ahead with insights on building agile, inclusive tea... ...more

Staffing

April 22, 2025•6 min read

Empowering Your Future: How Women Can Elevate Their Careers and Personal Growth Through New Opportunities

Find out how women can unlock new career opportunities and personal development through strategic approaches such as networking, upskilling, and establishing a strong personal brand. Ready to move for... ...more

Staffing

April 10, 2025•3 min read

The Ultimate Guide to HRM for Startups

Discover the ultimate guide to HRM for startups. Learn key strategies to build a strong team with Deerfield Employment Solutions. ...more

Staffing

April 04, 2025•2 min read

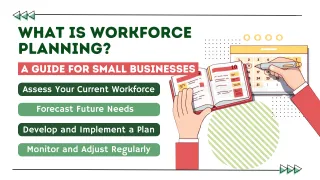

What is Workforce Planning?

Discover what workforce planning is and how it helps businesses align talent with goals. Learn more with Deerfield Employment Solutions. ...more

Staffing

April 04, 2025•3 min read

Why HRM Is the Backbone of Every Successful Company

Discover why HRM is essential for company success. Learn how Deerfield Employment Solutions helps build strong HR foundations for thriving businesses. ...more

Staffing

April 04, 2025•2 min read